Mike Gleason – July 25, 2019

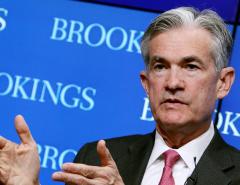

Chairman Powell’s testimony last week was closely scrutinized not just for its economic implications but also for its political overtones. Powell cited “trade tensions” as cause for concern about the strength of the global economy. He clearly seemed to be blaming President Trump’s tariffs.

But if the tariffs are what ultimately move the Fed to cut rates, Trump will have finally gotten what he wants out of Powell. In recent weeks, Trump has stepped up his attacks on the central bank, calling it the biggest problem facing the economy, floating the idea of firing Powell, and suggesting his administration would match China’s and Europe’s “currency manipulation game.”

Although many presidents before have pursued currency interventions and quibbled with Fed chairmen over interest rate policy, none have ever done it as openly and directly as the current one. Fed apologists in the media and in Congress view the central bank’s “independence” as being under assault.

The notion that the Fed ever was or could be independent of politics is a fanciful one. When a small group of people — appointed and confirmed by politicians — are empowered to make decisions that can make or break markets, economies, and elections, politics will inevitably intrude.

Fed chairman Jerome Powell may sincerely want to make monetary policy without regard to politics. But when political forces exert themselves on the Fed, he finds himself in an impossible catch-22. If he fails to cut rates, then the central bank risks becoming seen as the enemy of half the country as President Trump makes it his foil at campaign rallies. If Powell does what the President wants, then Democrats will accuse him of succumbing to political pressure from the White House.

Democrats used Powell’s Congressional testimony as an opportunity to get him on record in opposition to a gold standard.

Although Trump himself is not calling for a gold-pegged dollar, one of his nominees to the Fed Board of Governors is — or at least has in the past. Potential Fed policymaker Judy Shelton has written and spoken extensively about the gold standard.

Apparently seeking to discredit Shelton’s views, Democrat Jennifer Wexton prodded Fed Chairman Powell into weighing in on the gold standard.

Ms. Wexton: Chairman Powell, do you think that the US should go back to the Gold Standard for our currency?

Chairman Powell: Let me say I wouldn’t… This could feasibly be considered commenting on a particular nominee who has recommended that, and of course, I will not do that. I will answer your question, but I want to make sure that this isn’t interpreted in that way. So, no, I don’t think that would be a good idea. The idea would be… Congress would have to pass a law and that law would say that our job with monetary policy is to manage the level of the dollar, stabilize the dollar price of gold, and we would then not be looking at maximum employment or stable prices. There have been plenty of times in the fairly recent history where the price of gold has sent signals that would be quite negative for either of those goals.

Ms. Wexton: Much better mission for the Fed is what you’re doing right now.

Chairman Powell: Well, this is why every country in the world abandoned the Gold Standard some decades ago.

Ms. Wexton: Okay. Well, that reluctance or that desire not to go back to the Gold Standard is something that you have in common with the CEO’s of seven of the world’s globally systemic important banks.

It’s no surprise that “too big to fail” bankers who depend on special privileges from the Fed and other central banks don’t like gold. It’s hard to orchestrate multi-trillion dollar bailouts of the financial system when the currency supply is limited by gold .

Some see that as a disadvantage. Others see it as a distinct advantage because it discourages banks from getting too big to fail to begin with.

Chairman Powell claims that gold-backed money would prevent the Fed from pursuing full employment — as if all workers have monetary planners to thank for their jobs — and stable prices. Of course, by “stable prices” he means prices that rise at his target rate of two-percent inflation. He means a dollar that steadily loses purchasing power.

Sound money, on the other hand, is market-based money and can be based on gold, silver, or anything else the market values. If the dollar were defined simply in terms of grains of silver, for example, then monetary policy and the politics surrounding it would recede into the background. No longer would markets swing wildly based on the particular phraseology contained in Fed policy statements.

No longer would every incumbent administration push for easy money policies. Instead of counting on the Fed to devalue existing debt and pave the way to pile on more of it, hard choices would have to be made by members of Congress about paying down debt and embarking on a fiscally sustainable path.

The fact that politicians, central bankers, and “too big to fail” bankers all oppose a gold standard is a tacit admission that hard money would serve as an effective constraint on their activities.

This article was originally published at Mises.org.

Image source:Brookings via Flickr